With a history dating back to 1886, the Joshua Green Corporation continues to build on the legacy of our Founder, Joshua Green.

In 2024, JGC’s subsidiary PacWest Machinery acquired Miller Machinery, a leading crushing and screening equipment supplier to quarries and mining companies in the Pacific Northwest and Hawaii. Since its founding in 2007, Miller Machinery has established a reputation for unrivaled technical expertise and customer service. That tradition continues as an important business segment of PacWest Machinery.

We were pleased to make our initial investment in supporting a private equity firm as they acquired the majority interest in the company. And subsequently, we were able to lead a critical investment as ENTEK launched its efforts to build a US facility for the manufacturing of separators for lithium ion batteries.

Harry’s and Kettle Cuisine were two leaders in the fresh soup and sides market. By acquiring Harry’s in 2019 from JGC, Kettle Cuisine strengthened their nationwide footprint and added many terrific product lines and customer relationships to their portfolio.

We built Sage Lodge on the Yellowstone River in Montana to expand our presence in outdoor recreational activities. It provides a year-round destination for the aspiring and expert angler, outdoor enthusiasts, and those looking for a rejuvenating escape from the everyday. It has 50 guest rooms: 34 in the lodge and four stand-alone ranch houses. Sage Lodge combines nature and nurture in one of the most idyllic settings in America.

The JGC partnered with the Talbot family, owners of Bellingham Cold Storage since the 1940’s, buying the majority interest in 2018. BCS is one of the largest cold storage operators in the U.S., and its presence at the Port of Bellingham makes it the largest portside operator of cold storage.

Fly Water Travel is a premier travel company dedicated to arranging trips to the world’s finest fly-fishing destinations. The acquisition of Fly Water Travel enables Far Bank to provide a full-service, all-inclusive experience for anglers and outdoor enthusiasts who are passionate about fly-fishing.

Another example of JGC’s long-term investments is in stable industries that show attractive growth potential, such as the West Coast’s growing construction industry. Our acquisition of PacWest Machinery enabled us to become a supplier of Volvo construction equipment providing sales, parts, and service operations throughout Washington, Oregon and Northern Idaho.

Building on JGC’s acquisition of URG in 2012, the Touchstone acquisition combined two of the area’s most prominent real-estate firms enabling Urban Renaissance Group’s emergence as a developer.

Continuing to invest in the food business, JGC expanded its food production capabilities with the purchase of Portland’s Harry’s Fresh Foods.

JGC invested in support of Endeavour Capital’s acquisition of these leading specialty grocers in Southern California and Washington.

JGC’s growth by acquisition continues into the food sector, allowing it to add new products and categories to its existing line of natural soups and sauces that are delivered to customers as fresh and frozen.

JGC acquires Urban Renaissance Group, enabling it’s growth into one of the leading real estate operators and invest in the Pacific Northwest.

JGC partnered with the founder of PMI, allowing PMI to focus on its growth strategies as a designer and manufacturer of consumer goods including the Stanley brand.

PlayNetwork, a global provider of music, audio and branding services, was seeking growth capital that JGC provided to support its material and growth strategy.

Odom was founded in 1932 as an independent broker of beverages, JGC provided growth capital to Odom, which it used to substantially increase its presence in Alaska.

Now under our fly-fishing company –FarBank Enterprise– RIO continues to research, design and refine its fly-line products demonstrating passion, innovation and a pure love for the sport.

Adding Redington to its fly-fishing portfolio offered the beginner and intermediate fisherman quality fly-fishing equipment.

Founded in 1980 by legendary rod designer Don Green, Sage was created with one idea in mind – to build the world’s finest performance fly rods. The JGC acquired Sage in 1994 and has continued to expand its presence in fly fishing.

Local ownership came to an end when Peoples Bank was acquired by U.S. Bancorp of Oregon in a stock transaction valued at about $275 million. Joshua Green III, the chairman and chief executive of Peoples, said the bank was not abandoning its region. Its merger was “simply a reinvestment in banking in the Northwest.”

Joshua Green was a fan of saying, “I’m a regular Billy Graham for insurance companies,” which made sense given that he was one of the first stockholders of Safeco Insurance Co. (formerly General Insurance Company). Safeco earned praise for its competitive prices and superb service.

“Don’t put all your eggs in one basket.” Following that bit of American folklore, Joshua Green began his banking career. Convinced of the value of personal contacts with prospective customers, Green wasted no time in making friendly calls on prominent citizens. Three generations of Joshua Greens ran the bank as Chairman and CEO until its sale to the U.S. Bank.

Joshua Green bought the Port Townsend Southern Railroad after it occurred to him it would provide a fine passenger freight link with his steamers. For 40 years, Joshua Green was the only West Coast member of the board of directors of the Chicago, Milwaukee and St. Paul Railroad.

The corner lot at 4th Avenue and Pike Street was occupied by several ramshackle stores, including a movie theater and a butcher shop. Fearing bubonic plague from rats brought over from the Orient, City officials ordered the butcher shop closed. The ramshackle wooden stores were soon demolished and the 10 story Joshua Green Building rose in their place.

Facing stiff competition vying for business on the waters of Puget Sound, Joshua Green’s original shipping business, the La Conner Trade & Transportation Co., merged with Alaska Steamship Company, began rapidly expanding , and was renamed as The Puget Sound Navigation Company.

“You don’t get rich working on a steamboat… you get rich owning steamboats.” Joshua Green approached Jacob Furth about borrowing $5,000 to buy a good stern-wheeler and a scow. Furth stated “I think you’ll pay it back” at which point Joshua Green, Sam Denny, Peter Falk, and Frank Zikmund were in business.

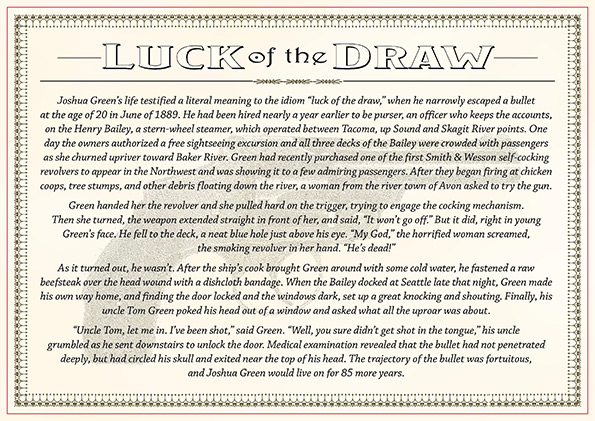

When a young woman from Avon asked to try out Joshua Green’s new Smith and Wesson self-cocking revolver she turned towards him exclaiming “it won’t go off.” But, it did – right in his face. The bullet circled part of his skull and exited near the top of his head. Miraculously he survived!

At the age of nineteen, Joshua Green traveled with his family by rail from Jackson, Mississippi, through Chicago, St. Paul, Spokane Falls, and Portland all before arriving at the landing dock in Tacoma, Washington. Once there, a small steamboat by the name of Edith took them the last 28 miles to their new home—Seattle.